Although they have drawback comments

Beginning with this issue, The Korea Post, publisher of 3 English and 2 Korean-language news publications since 1985, begins covering the largest business conglomerates in Korea named Jaebeol or business tycoons. This month the business organization covered is Samsung Business Group.

According to the free world encyclopedia of Wikipedia, Jaebeol is a large industrial conglomerate that is run and controlled by a person or family in Korea.

A Jaebeol often consists of many diversified affiliates, controlled by a person or group of persons whose power over the group often exceeds legal authority. The first known use in an English text was in 1972. Several dozen large Korean family-controlled corporate groups fall under this definition.

In Korea today, there are an estimated total of 100 big business groups classified Jaebeol, which, according to Wikipedia and other business media sources, including the following business groups:

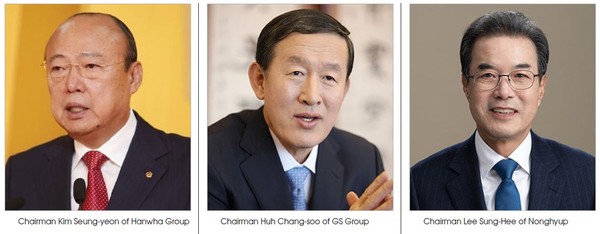

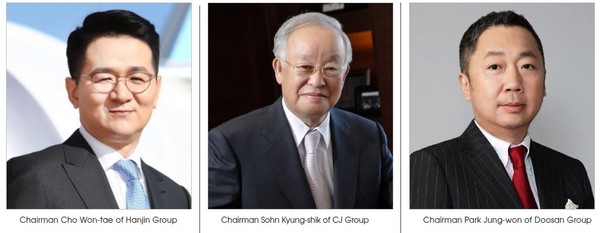

Samsung, Hyundai Motor Company, SK, LG, Lotte Group, POSCO, Hanwha, GS, NongHyup, Hyundai Heavy Industries, Shinsegae, KT, Hanjin Group, CJ, Doosan, Booyoung, LS, Daelim, Mirae Asset, S-Oil, Hyundai Department Store, Hyosung, Korea Investment Holdings, DSME, Young Poong, Harim, Kyobo, Kumho Asiana, Korea Tobacco & Ginseng Corporation, KOLON, KIA, KEPCO, Korea Land & Housing Corporation, Shinhan Financial Group, Woori Financial Group, and Naver Corporation.

These Jaebeol business groups are known to have played a significant role in the Korean politics. In 1988, a member of a Jaebeol family, Chairman Chung Mong-joon of Hyundai Heavy Industries successfully ran for the National Assembly in Korea. Other business leaders also were chosen to be members of the National Assembly through proportional representation.

Hyundai has made efforts to contribute to the thawing North Korean relations, but not without controversy. Many South Korean family-run Jaebeol groups have been criticized for low dividend payouts and other governance practices that favor controlling shareholders at the expense of ordinary investors.

The word, Jaebeol, consists of Jae (wealth or property) and Beol (faction or clan) and derives from the characters 財閥 pronounced ‘Zaibatsu’ in Japan. The first known use of the expression, according to Wikipedia, is in an English text in 1972.

The Korean economy was small and predominantly agricultural well into the mid-20th century. However, the policies of the then President Park Chung-hee spurred rapid industrialization by promoting large businesses, following his seizure of power in 1961. The First Five Year Economic Plan by the government set industrial policy toward new investment, and Jaebeol groups were to be guaranteed loans from the banking sector. Jaebeols played a key role in developing new industries, markets, and export production, helping make Korea one of the Four Asian Tigers.

Although Korea's major industrial programs did not begin until the early 1960s, the origins of the country's entrepreneurial elite were found in the political economy of the 1950s. Very few Koreans had owned or managed larger corporations during the Japanese colonial period. After the departure of the Japanese in 1945, some Korean businessmen obtained the assets of some of the Japanese firms, a number of which grew into the Jaebeol groups of the 1990s.

The companies, as well as certain other firms that were formed in the late 1940s and early 1950s, had close links with the First Republic of Korea of the late President Syngman Rhee, which lasted from 1948 to 1960. It is confirmed that many of these companies received special treatment from the government in return for kickbacks and other payments.

When the military took over the government in 1961, its leaders announced that they would eradicate the corruption that had plagued the Rhee Administration and eliminate "injustice" from society. Some leading industrialists were arrested and charged with corruption, but the new government realized that it would need the help of entrepreneurs if the government's ambitious plans to modernize the economy were to be fulfilled. A compromise was reached, under which many of the accused corporate leaders paid fines to the government. Subsequently, there was increased cooperation between corporate and government leaders in modernizing the economy.

Government-Jaebeol cooperation was essential to the subsequent economic growth and astounding successes that began in the early 1960s. Driven by the urgent need to turn the economy away from consumer goods and light industries toward heavy, chemical, and import-substitution industries, political leaders and government planners relied on the ideas and cooperation of Jaebeol leaders. The government provided the blueprints for industrial expansion; the Jaebeol realized the plans. However, the Jaebeol-led industrialization accelerated the monopolistic and oligopolistic concentration of capital and economically profitable activities in the hands of a limited number of conglomerates.

The late President Park used the Jaebeol business group leaders as a means towards economic growth. Exports were encouraged, reversing Rhee's policy of reliance on imports. Performance quotas were established.

Jaebeol groups grew because of two factors--foreign loans and special favors. Access to foreign technology also was critical to the growth of the Jaebeol through the 1980s. Under the guise of "guided capitalism," the government selected companies to undertake projects and channeled funds from foreign loans.

The government guaranteed repayment should a company be unable to repay its foreign creditors. Additional loans were made available from domestic banks. In the late 1980s, the Korean Jaebeol business groups dominated the industrial sector and were especially prevalent in manufacturing, trading, and heavy industries.

The Jaebeol business conglomerates experienced tremendous growth beginning in the early 1960s in connection with the expansion of the Korean exports. Growth resulted from the production of a diversity of goods rather than just one or two products. Innovation and the willingness to develop new product lines were critical.

In the 1950s and early 1960s, Jaebeol businesses concentrated on wigs and textiles; by the mid-1970s and 1980s, heavy, defense, and chemical industries had become predominant. While these activities were important in the early 1990s, real growth was occurring in the electronics and high-technology industries. Jaebeol businesses also were responsible for turning the trade deficit in 1985 to a trade surplus in 1986. The current account balance, however, fell from more than US$14 billion in 1988 to US$5 billion in 1989.

Jaebeol groups are still largely controlled by their founding families while keiretsu are controlled by groups of professional managers. Jaebeol, furthermore, are more family based and family oriented than their Japanese counterparts.

Jaebeol groups are centralized in ownership while keiretsu are more decentralized. They have more often formed subsidiaries to produce components for exports while large Japanese corporations have mostly switched to employing outside contractors.